What Big Data Means for Radio:

There’s been plenty of discussion on what big data can do — tracking public health threats like the flu or improving the performance of an elite sports athlete.

But what might it mean for radio?

At the NAB Show, the issue of big data and radio measurement will be part of sessions like “What’s the Big Data Deal for Radio,” where the concept of analytics and their power in determining listener preferences and impacting purchases will be up for debate.

Every aspect of the content business increasingly will be affected by data and the analytics and insights built on it, said Rick Ducey, managing director of the research firm BIA/Kelsey.

“Audience data, advertising data, content metadata, marketing data — all tied to developing smarter product roadmaps, smarter business models and smarter executions — will be tied to future success,” he said.

DEEPER INSIGHT

At its simplest, big data is a way to give broadcasters a complete understanding of a radio audience across various platforms, including online and OTA.

“Our industry is at a point when big data needs to be considered as a possible opportunity to improve stability, reliability, and validity of our current measurement,” said Buzz Knight, vice president of programming for the Beasley Media Group, which owns more than 60 radio stations.

Buzz Knight, vice president of programming for the Beasley Media Group, said the company is using big data to get a relevant picture of the changing radio industry.

Knight will serve as moderator of the “Big Data Deal” panel in Las Vegas. “The marketplace is clamoring for this discussion both from a measurement front and certainly from a business standpoint.”

With big data analysis techniques, radio stations can, for example, use archived media information to create a complete picture of the effectiveness of an advertising campaign. Consider the media monitoring firm Critical Mention, which captures and indexes 40 hours of broadcast content every 60 seconds from 2,000 unique broadcast sources, giving users a look at a database of millions of searchable segments.

Radio stations might use the data from media measurement to show advertisers how often their brand aired in any geographically or age-segmented market and why that ad run should continue based on the use of additional data such as smart device ownership, drive time peaks or radio vs. app listenership.

For radio, the techniques gleaned from analytics can give stations the ability to better determine patterns of consumption, offer more detailed insights into a specific marketplace and allow radio station ad sales staff to set new strategies and goals.

In today’s marketplace where consumers have so many platforms competing for their attention, big data metrics becomes even more relevant. “It’s important as a way to evaluate what footprint some of these new platforms have and what opportunities they open up for the future of measurement,” Knight said.

ON THE ROAD

This is particularly relevant, Knight said, as it relates to in-car measurements.

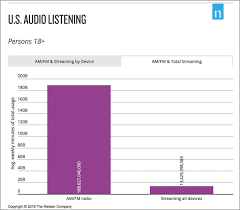

As the audio landscape continues to evolve, radio remains the top way to reach consumers across all media platforms — and in particular, radio in the car. According to the most recent Nielsen Comparable Metrics Report, each week, more Americans tune into AM/FM radio (93 percent) than watch television, use smartphones, use tablets or use computers. And that listening is primarily in the car.

Connected car technology is part of the big data discussion. Shown is a 7-inch iLX-107 screen with CarPlay connectivity from Alpine.

On a typical weekday, radio’s share of in-car listening is 64 percent, following distantly by other means like satellite radio and personal media libraries, according to a recent Jacobs Media report.

What broadcasters now need is a more efficient means of gathering data on that in-car radio listening, and how stations can best target those listeners. “One thing for certain is that some of the new big data offerings offer a view of in-car measurement that paints a [clearer] picture of consumer behavior,” Knight said.

What’s missing in today’s current measurement options is the next step in the evolution of audience measurement.

“Measurement [now] needs to evolve and innovate to give a complete picture of the consumer,” Knight said. Big data metrics offer an opportunity to provide some type of hybrid measurement of data that will give stations a complete picture, he said.

Broadcasters are finding that important data is coming from innovative new places. Megan Lazovick from Edison Research will talk during the session about consumer data emerging from virtual assistants like Alexa and Google Home.

“We conducted multiple studies within the past year to learn about how consumers are behaving with the smart speaker,” she said. “We saw that these devices in the home gradually become more and more adopted, and actually change and create new behaviors that had not existed.” Today, 42 percent of smart speaker owners now say that their smart devices are essential to their everyday lives.

The “Big Data Deal” session also will include panelists from the Katz Media Group and Connected Travel.

Other relevant sessions at the show include “Don’t Let Big Data Become a Massive Liability” in the Broadcast Engineering and Information Technology Conference; “Big Data and Big Brother: News, Privacy & Piracy” at the Destination: NXT Theater (North); and “CM | IP Debate: Understanding Big Data and the Role of Analytics in TV” in the Connected Media | IP Pavilion.

Source: radioworld.com

Leave a Reply